Pa Labor Tax Rate . Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; Pennsylvania state income tax (sit) rates. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on dec. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania levies a flat state income tax rate of 3.07%. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is.

from www.strashny.com

When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on dec. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania state income tax (sit) rates.

Pennsylvania Cuts Corporate Net Tax Rate Laura Strashny

Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania state income tax (sit) rates. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on dec. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; When a business starts to pay wages for the first time, it is assigned a new employer basic.

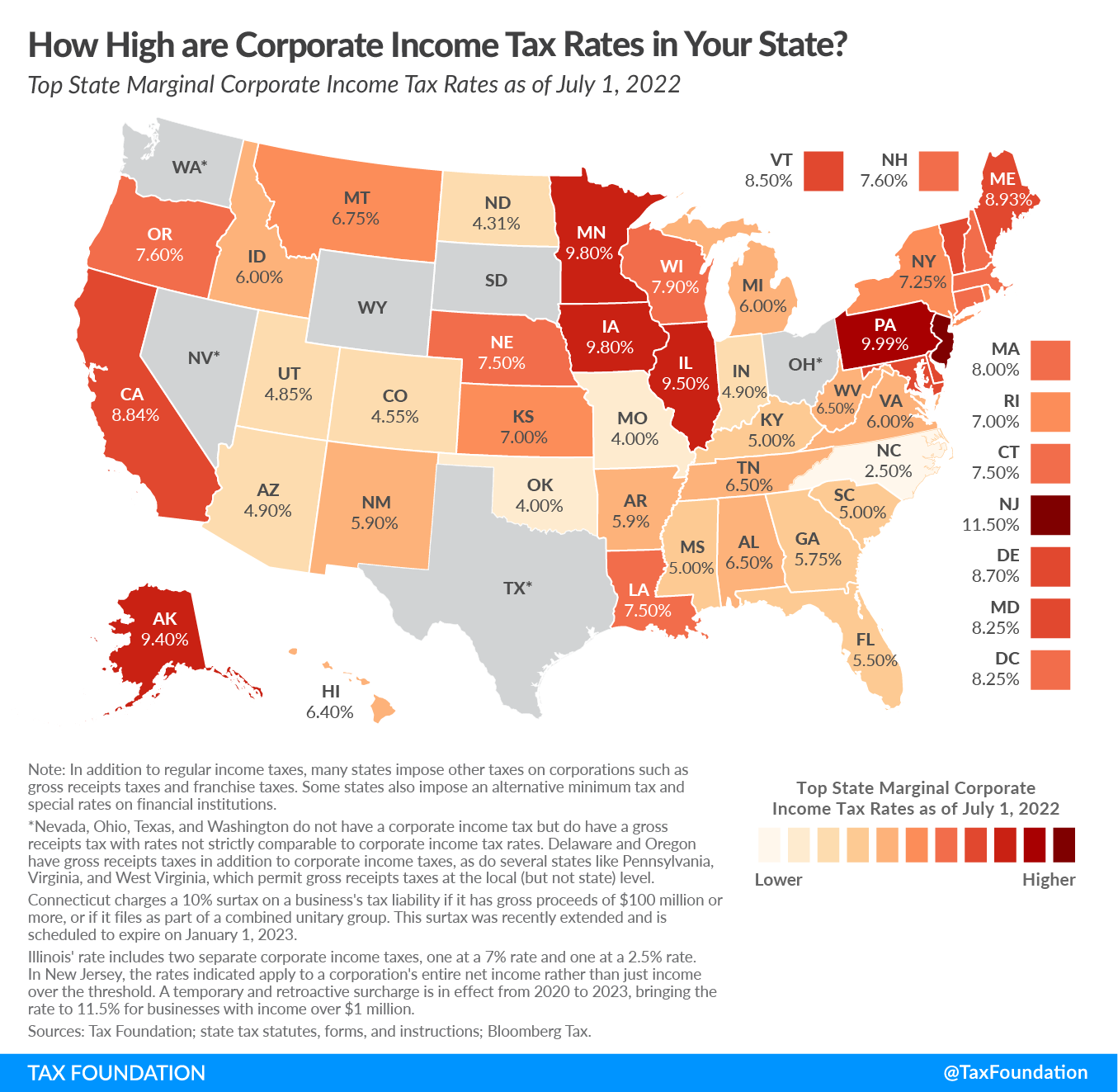

From taxfoundation.org

Labor Taxes Compliance and Administrative Tax Burden on Businesses Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania state income tax (sit) rates. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania released its unemployment insurance tax rate information for 2023. Pa Labor Tax Rate.

From www.researchgate.net

6 Labor tax rates Notes The left panel displays the average labor tax Pa Labor Tax Rate Pennsylvania levies a flat state income tax rate of 3.07%. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. When a business starts to pay wages for the first time, it is assigned a new. Pa Labor Tax Rate.

From capitalismforall.wordpress.com

Taxes Across the U.S. Compared with Political Parties Capitalism for All Pa Labor Tax Rate When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on dec. Pennsylvania levies a flat state income tax rate of 3.07%. Therefore, your income level and filing status will not affect the income tax rate. Pa Labor Tax Rate.

From chrisbanescu.com

Top State Tax Rates for All 50 States Chris Banescu Pa Labor Tax Rate Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on dec. Therefore, your income level and filing status will not affect the income tax rate you. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania state income tax (sit) rates. When a. Pa Labor Tax Rate.

From www.whitehouse.gov

The Labor Supply Rebound from the Pandemic CEA The White House Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. Pennsylvania state income tax (sit) rates. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; Pennsylvania levies a flat state income. Pa Labor Tax Rate.

From www.pdffiller.com

Wage Statement Template Fill Online, Printable, Fillable, Blank Pa Labor Tax Rate Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania state income tax (sit) rates. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same;. Pa Labor Tax Rate.

From taxfoundation.org

State Corporate Tax Rates and Brackets for 2020 Pa Labor Tax Rate Pennsylvania state income tax (sit) rates. Pennsylvania levies a flat state income tax rate of 3.07%. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania has a flat income tax rate. Pa Labor Tax Rate.

From www.icsl.edu.gr

Where'S My State Tax Refund Pennsylvania Pa Labor Tax Rate Pennsylvania levies a flat state income tax rate of 3.07%. When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate. Pa Labor Tax Rate.

From www.researchgate.net

Selected State and Federal Prevailing Wages Compared to BLS Wages Pa Labor Tax Rate Pennsylvania state income tax (sit) rates. When a business starts to pay wages for the first time, it is assigned a new employer basic. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania has a flat income tax rate of 3.07%, meaning all. Pa Labor Tax Rate.

From cs.thomsonreuters.com

Pennsylvania How to determine which local taxes should calculate Pa Labor Tax Rate Therefore, your income level and filing status will not affect the income tax rate you. When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on dec. Pennsylvania has a flat income tax rate of 3.07%,. Pa Labor Tax Rate.

From kittelsoncarpo.com

Salary Structures and Wages Computation in the Philippines Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania levies a flat state income tax rate. Pa Labor Tax Rate.

From paaflcio.com

Pennsylvania AFLCIO Labor 2022 Zones Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. When a business starts to pay wages for the first time, it is assigned a new employer basic. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania released its unemployment insurance tax rate information. Pa Labor Tax Rate.

From retail-support.lightspeedhq.com

Setting labor taxes and labor rates Lightspeed Retail (RSeries) Pa Labor Tax Rate Pennsylvania state income tax (sit) rates. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same.. Pa Labor Tax Rate.

From fitsmallbusiness.com

State & Federal Labor Laws Employers Need to Know Pa Labor Tax Rate Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; Pennsylvania levies a flat state income tax rate of 3.07%. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania released its unemployment insurance tax rate information for 2023 in a contribution rate table issued on. Pa Labor Tax Rate.

From slideplayer.com

Economics 332 Spring 2013 © copyright by Casey B. Mulligan ppt download Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania state income tax (sit) rates. Therefore, your income level and filing status will not affect the income tax rate you. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. When a business starts to. Pa Labor Tax Rate.

From www.facebook.com

Pennsylvania Laborers' District Council Pittsburgh PA Pa Labor Tax Rate When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania 2021 sui tax rate factors and taxable wage base to remain the same; Pennsylvania levies a flat state income tax rate of 3.07%. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate. Pa Labor Tax Rate.

From www.policymattersohio.org

Unemployment compensation for lowpaid workers Pa Labor Tax Rate The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding rate is. Pennsylvania state income tax (sit) rates. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. Pennsylvania 2021 sui tax rate factors and taxable wage base. Pa Labor Tax Rate.

From www.researchgate.net

Laffer curves for labor tax rates for the United States (solid line Pa Labor Tax Rate When a business starts to pay wages for the first time, it is assigned a new employer basic. Pennsylvania levies a flat state income tax rate of 3.07%. Pennsylvania has a flat income tax rate of 3.07%, meaning all residents pay the same. The pennsylvania department of labor & industry announced that effective january 1, 2023, the employee sui withholding. Pa Labor Tax Rate.